How to use the ‘Gift and Loan-Back’ Strategy to Protect a Your Family Home

To better safeguard your valuable assets, the simplest thing to do is to transfer your valuable assets to a safer structure, such as a trust. However, unless exemptions or concessions apply, transferring valuable assets will often trigger significant capital gains and/or stamp duty.

Gift and Loan Back Arrangements

Lets use an example where you may have a home owned by a 'high risk' individual and we want to protect the the home in the event that person gets sued.

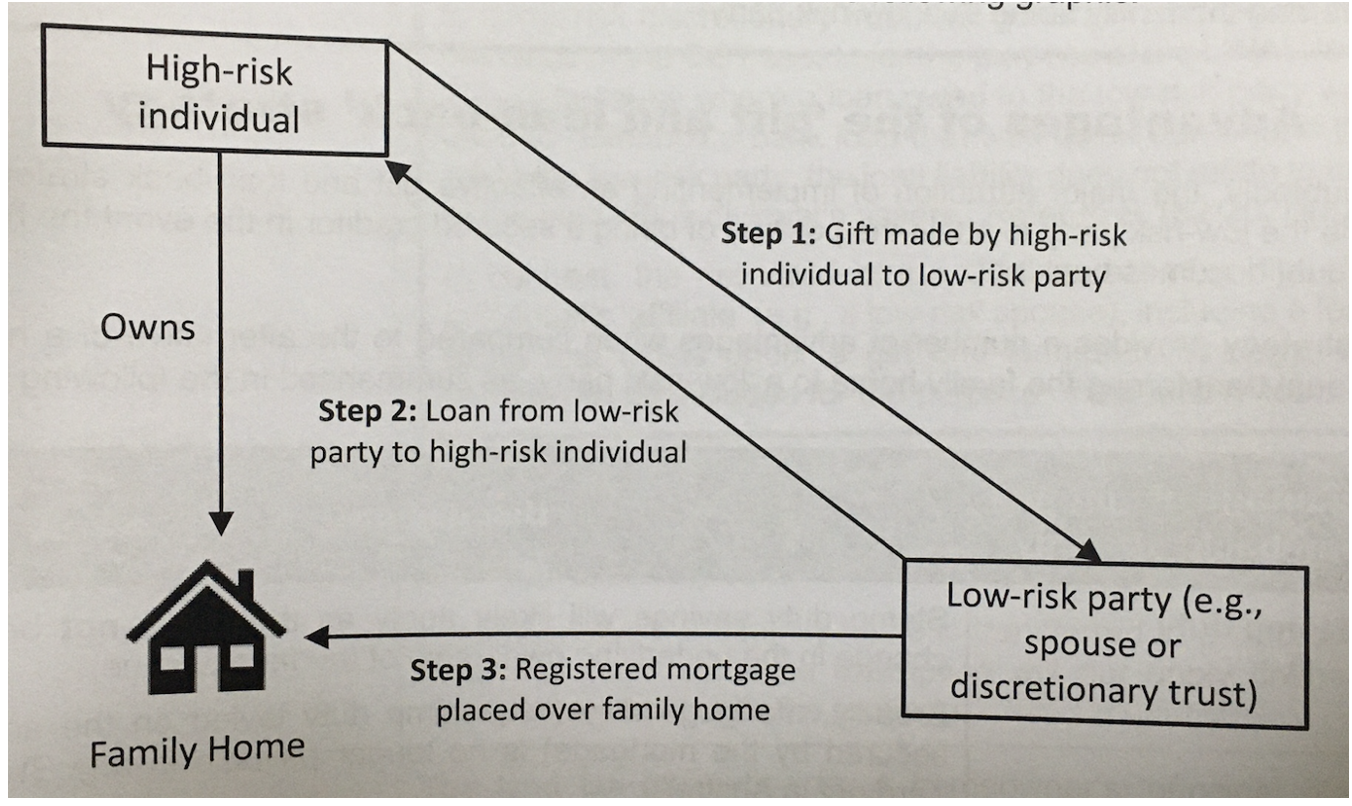

As an alternative to transferring the asset, a common asset protection strategy is to implement a ‘Gift and Loan Back’ arrangement which is broadly implemented under the following three-step process.

Step 1: An amount of money equal to the equity in the family home is gifted by the ‘high-risk’ individual to a ‘low risk’ party (e.g. a low-risk spouse or discretionary Trust). The ‘high risk’ party will often borrow the gifted amount from a bank.

Step 2: The ‘low risk’ party agrees to make a loan back to the ‘high risk’ individual, who can use the proceeds to repay the loan to the bank (if applicable).

Step 3: The ‘low risk’ party takes out a registered mortgage over the family home as security for providing the loan to the ‘high risk’ individual.

It looks like this:

From an asset protection perspective Step - 3 is the key to the successful implementation of the gift and loan back strategy. By registering a mortgage over the family home, the ‘low risk’ party will be treated as a secured creditor in event of the bankruptcy of the ‘high risk’ individual homeowner. In this case that registered mortgage will help ensure the ‘low risk’ party is paid in priority to other unsecured creditors (subject to the bankruptcy clawback rules). i.e. If the transaction was established to ‘defeat creditors’ it can be reversed (without any time limits).

This article in no way constitutes legal advice. It is general in nature and is the opinion of the author only. You should seek

legal advice tailored to your individual circumstances before acting on anything related to this article.