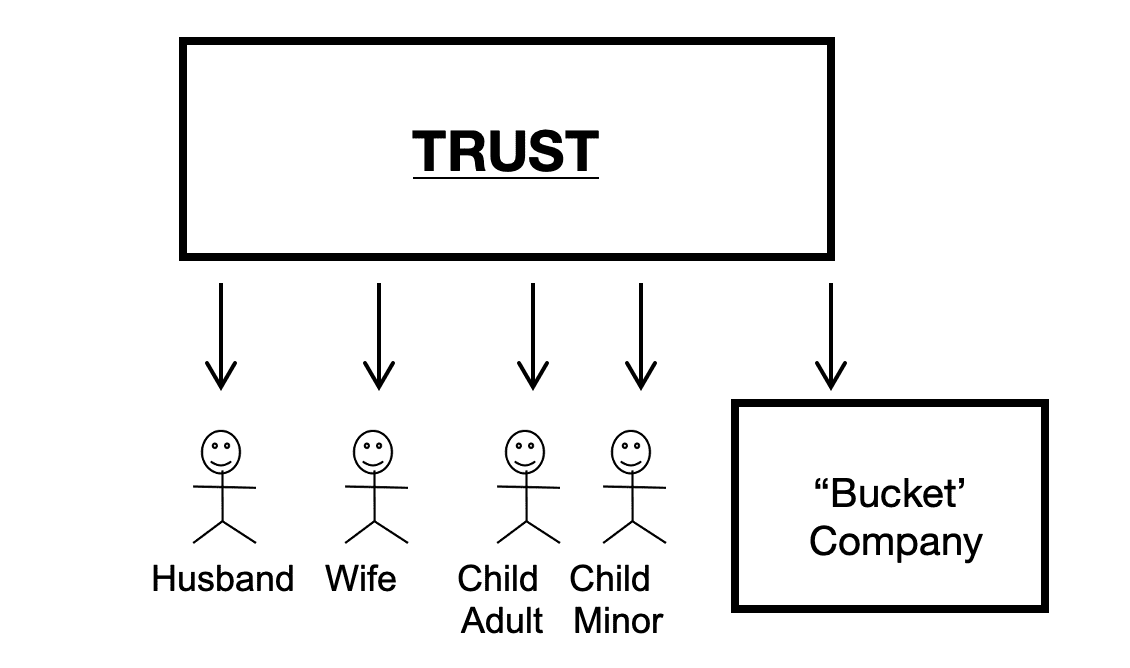

How Can a 'Bucket' Company Reduce my Tax?

So what is a 'bucket' company and how can it help me reduce my tax? It is simply a company that you distribute income to from your

Family Trust.

How does this work in practice? You run your business or Medical Service Entity

via a Trust. The Trust makes a profit and then distributes this as income to the family beneficiaries. This is mum, dad and the

children. This is to use up their low marginal tax rates. When there is no one left on low marginal tax rates then the trust then

distributes the balance of the income to the ‘bucket’ company. The ‘bucket’ company then pays a flat rate of tax currently

25% for the 2022 financial year. For example: Let's say , mum and dad run their business in a trust structure. They

have an adult child, one minor and have set up a 'bucket' company.

Their structure would look like this;

Suppose the income from the Trust to be distributed is $500,000. We distribute $45,000 each to dad, mum, and the adult child

(thus leaving their top income in the 19% bracket) and give $416 to the minor. The remaining $364,584 is distributed to the

'bucket' company and get's taxed at a flat rate currently 25% for 2022.

The distributions can be summarised as follows:

| Mum | $ 45,000 |

| Dad |

45,000 |

| Child (Adult) |

45,000 |

| Child (Minor) | 416 |

| Bucket Company |

364,584 |

| Total Distribution | $ 500,000 |

The tax payable by each beneficiary based on tax rates for 2022, would be:

| Mum |

$ 5,992 |

| Dad |

5,992 |

| Child 1 |

5,992 |

| Child 2 |

Tax Free |

| Bucket Company at 25% |

91,146 |

|

TOTAL TAX PAID Average tax rate = 22% |

$109,122 |

If the Trust was set up without a 'bucket' company and all income was distributed equally to the family adult

beneficiaries, the tax payable would be $150,198. This means that by using a 'bucket' company you would receive a TAX

SAVING

of 27% or $41,076 in tax. If you did this every year, the accumulated tax savings would be significant. Once the

‘bucket’ company pays it's tax, the balance of funds can be invested to maximise the returns for the shareholders. But,

like any strategy, while their are advantages, you must also consider the challenges.

WHAT YOU NEEED TO KNOW ABOUT A 'BUCKET' COMPANY

#1: The Trust Must Physically Transfer the Money into the Bucket Company’s Bank Account

If you decide to distribute Trust income to a ‘bucket’ company, you must physically transfer the money into the ‘bucket’ company’s bank

account before lodging its tax return. So the first challenge is having this money available without adversely affecting your cash

flow. If you cannot do this, you will need to establish a Division 7A loan between the Trust that is distributing the income and the

‘bucket’ company that has not received the payment. A Division 7A loan has a maximum term of 7 years,

has a minimum annual repayment plan and has interest payable at a rate set by the ATO each financial year.

#2: Getting Money Out of the 'Bucket' Company

You cannot just take money out of a company because it belongs to the ‘bucket’ company. If you want to take money out, you can pay a dividend to the shareholders of the bucket company. Because this dividend has already been taxed at the company tax rate, the shareholders receive a (franking) credit on the tax already paid. In practical terms, if the ‘bucket’ company paid tax on the income at 25%, then the imputation or franking credit is 25%.

If the company declares a dividend to mum and dad and their tax rate is 47%, because the ‘bucket’ company has already paid 25%, the mum and dad will only pay the difference in tax of 22%.

If, however, mum and dad are retired and their income is low, they can, over time, drip-feed dividends into their names. This means they could potentially receive a refund from the ATO on imputation credits paid on dividends they received from the 'bucket' company.

#3: What do You do with the Money in the 'Bucket' Company?

Once money is distributed to a ‘bucket’ company, the trust’s cash is now within the company and can be invested. A bucket company acts as an effective investment vehicle, particularly for shares and index funds in Australia. Why? Because dividends from Australian companies carry 30% franking credits, meaning the company won’t pay additional tax on them.

What about capital gains tax? While companies don’t receive the 50% CGT discount, they only pay tax at 25%—much lower than the top individual rate of 47%. This creates a tax saving of up to 17% each year, making bucket companies attractive for high-income taxpayers who have already maximised super contributions and family distributions.

The company invests after paying 25% tax and may later distribute fully franked dividends to a family trust. When allocated to low-rate beneficiaries, these dividends can generate refunds of franking credits, reducing the effective tax rate below 25%—sometimes even to nil.

In short, companies remain highly tax-efficient investment vehicles because:

- Individuals can invest 75 cents per dollar through the company versus only 53 cents in their own name.

- The lower tax rate boosts after-tax returns, accelerating compounding growth.

Think of it like a snowball: starting bigger and rolling faster, it grows much larger over time.

#4: Who should be the shareholder?

The shares in the investment company should be owned by a separate family trust controlled by the business owner or a trusted relative. This creates asset protection advantages, and allows for future franked dividends paid by the investment company to be channeled to a low tax rate beneficiary, thereby reducing the overall level of tax payable on the service company income (and the investment earnings thereon).

As you can see, this strategy, has it's advantages, but also has strict ATO rules you must follow. So before you decide if it's for

you, we invite you to book a free, one-hour introductory consultation to discuss your situation. To book a

time, contact us today or complete your details in the box at the top of this page.

Nick

Tolevsky is a Specialist Medical Accountant. He provides expert guidance on tax strategies, building and protecting wealth . If

you’re interested in discussing how we can help you, please book a complimentary consultation by clicking

here

Nick

Tolevsky is a Specialist Medical Accountant. He provides expert guidance on tax strategies, building and protecting wealth . If

you’re interested in discussing how we can help you, please book a complimentary consultation by clicking

here

Disclaimer: This article contains general information only and no responsibility can be accepted for errors, omissions or possible misleading statements. It is not designed to be a substitute for professional advice and does not take into account your individual circumstances. Therefore, no responsibility can be accepted for any action taken as a result of any information contained in this article.