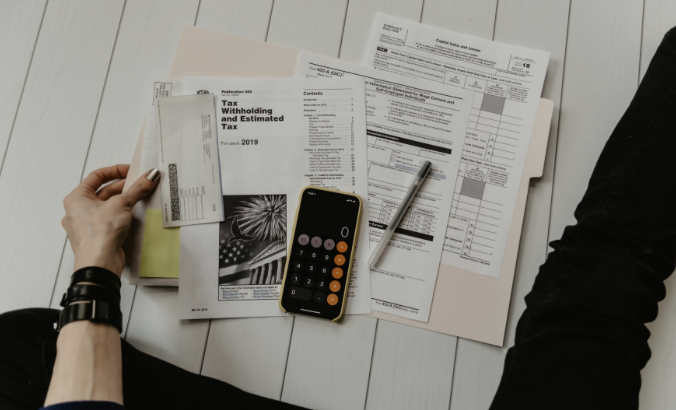

Question 3 - What Tax Records Do I Need To Keep And For How Long?

As the burden of proof falls upon the taxpayer in event of any dispute it is imperative that adequate, well organised records are kept for the statutory periods as set out in the Income Tax Assessment Act. Generally, this is for 5 years from the end of the relevant records. There are penalties for not keeping records and it will reduce the risk of tax audit and adjustments if the records are kept and maintained for the required statutory period.

Statutory requirements are contained in Section 262A of the Income Tax Assessment Act 1936 (ITAA 1936) - and the requirements are that people (including companies) carrying on a business must keep adequate records that support and explain all transactions relevant to that Act.

Statutory requirements are contained in Section 262A of the Income Tax Assessment Act 1936 (ITAA 1936) - and the requirements are that people (including companies) carrying on a business must keep adequate records that support and explain all transactions relevant to that Act.

In particular this would include:

- All documents supporting amounts of income and expenditure

- All documents showing any estimates, elections, calculations or determinations relevant to the Act and showing basis for and methods used to arrive at an estimate, determination or calculation

All records must be in plain English (or convertible to English) and be easily accessible and should be kept for 5 years. This would include records that are kept in paper or electronic form.

Records for Capital Gains Tax Purposes

Similar to the Income Tax Section 262A, the section 121-20 of the Income Tax Assessment Act 1997 (ITAA 1997) requires that taxpayers must keep records of all acts, transactions or events which could reasonably be expected to give rise to a Capital Gain or Loss through a Capital Gains Tax Event (refer Capital Gains Tax section). These events may have already happened or could be future events. These records must again show details of how the acts, transactions, events or circumstances are relevant in calculating whether a capital gain or loss has been made. These records must be held for 5 years after it is certain that no CGT event can or will happen.

Electronic or Paper Records?

Original records can be kept in paper format or electronically. However, all records must be secure and software should provide an audit trail so that entries cannot be easily altered. It must contain all the relevant information and can be maintained by the taxpayer or by someone else (eg. Your registered tax agent). Where paper records have been converted to electronic records they satisfy requirements if they are not altered once stored, kept for five years and can be retrieved and read at any time by Tax Office staff.

OTHER QUESTIONS IN THIS SERIES:

- What Steps are Involved in Starting a Business?

- Do I Have to Register for GST?

- What Tax Records Do I Need to Keep for My Business

- What Is a Business Activity Statement?

- What’s the difference between an ABN and an ACN?

- Do I have to include GST on my Invoices?

- What Software do You Recommend for My Start-Up Business?

- How Much Tax Do I Pay?

- Can I claim my motor vehicle expenses?

- What Do I Need to Do When I Employ My First employee?

- What’s the most appropriate tax structure for my business?

- Are You Small Business Experts?

- How Much Do You Charge?

- How Do I Change Accountants?

- How Do PAYG Tax Instalments Work?

- How Do I repay my HECS debt?